Portugal - The Republic of the Moneyed: A Country Where Money Refuses to Work

- Money accumulation is not the same as wealth creation.

- Offshore financial centres absorb a significant share of Portuguese capital.

- Capital that does not circulate weakens productivity and innovation.

- Rent-seeking economies generate inequality and stagnation.

- True wealth implies responsibility toward society.

The Republic of the Moneyed

Portugal is often said to have "rich people". It does not. What it truly has is a growing class of moneyed individuals — people with capital, but without purpose.

Wealth is not measured by balance sheets. It is measured by what money does. Factories, laboratories, technology, exports, qualified employment — these are the organs of real wealth.

The Portuguese moneyed elite rarely builds any of this. It accumulates. It protects. It relocates. It earns here — and stores elsewhere.

The patriotism of the offshore account

Modern patriotism has become remarkably portable. The flag remains at home; the capital departs quietly at night.

This is not investment diversification. It is national desertion with a legal advisor.

Portugal functions as a resource-extraction territory: cheap labour, fragile regulation, compliant consumption — while profits migrate to jurisdictions where responsibility does not exist.

Low wages, high margins, zero vision

The dominant economic model rewards: low salaries, high prices, minimal reinvestment, maximum dividends.

Innovation is praised in speeches, but avoided in practice — because innovation demands risk, and risk frightens rent-seekers.

The result is predictable: young talent emigrates, industry stagnates, productivity collapses, and the country grows old before it grows strong.

Capital that does not circulate becomes poison

Money locked in offshore accounts does not generate prosperity. It generates inertia.

Capital that refuses to work is no longer capital — it is economic cholesterol, blocking the arteries of development.

A society cannot innovate when its financial elite prefers interest over invention.

The national paradox

Portugal displays luxury without industry, real estate without research, wealth without productivity.

Cars exist. Factories do not. Buildings multiply. Laboratories disappear.

It is the economy of appearance — rich in assets, poor in future.

Epilogue: Wealth is a duty

In a functional society, those who possess more carry greater responsibility.

Not as charity — but as economic logic.

Without productive investment, without fiscal commitment, without long-term vision, money becomes sterile.

Portugal does not lack capital. It lacks a class willing to transform capital into civilisation.

Money alone builds nothing. Only purpose does.

Sources & References

- EU Tax Observatory "Who owns the wealth in tax havens?" https://www.taxobservatory.eu/repository/who-owns-the-wealth-in-tax-havens-macro-evidence-and-implications-for-global-inequality/

- Tax Justice Network – State of Tax Justice 2024 https://taxjustice.net/reports/state-of-tax-justice-2024/

- OECD – Harmful Tax Practices https://www.oecd.org/tax/beps/harmful-tax-practices/

- Banco de Portugal – BPstat International Investment Position & Offshore Flows https://bpstat.bportugal.pt

- IMF – Offshore Tax Havens and Inequality https://www.imf.org/en/Publications/fandd/issues/2019/09/offshore-tax-havens-and-inequality

- Corporate Tax Haven Index https://cthi.taxjustice.net

- Atlas of Offshore Wealth https://atlas-offshore-world.org

Note: Offshore estimates vary by methodology. For robustness, this article combines institutional statistics, academic research and international comparative datasets.

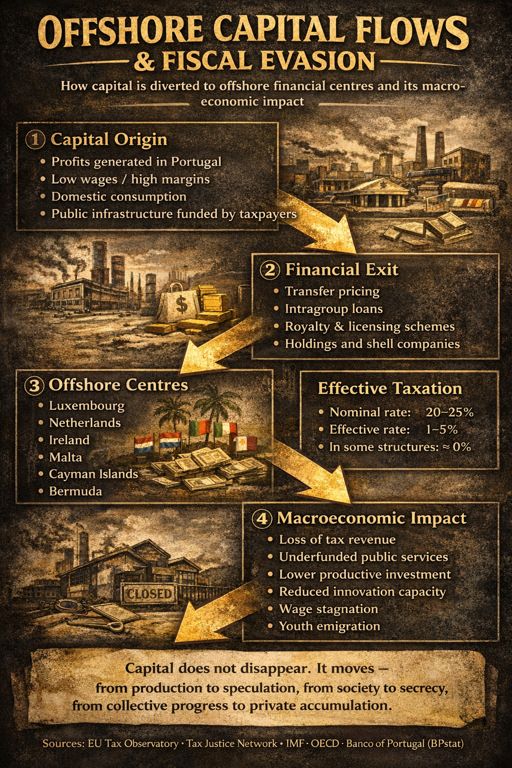

Infographic — Offshore Capital Flows & Fiscal Evasion

▸ Profits generated in Portugal

▸ Low wages / high margins

▸ Domestic consumption

▸ Public infrastructure funded by taxpayers

▸ Transfer pricing

▸ Intragroup loans

▸ Royalty & licensing schemes

▸ Holdings and shell companies

▸ Luxembourg

▸ Netherlands

▸ Ireland

▸ Malta

▸ Cayman Islands

▸ Bermuda

▸ Nominal rate: 20–25%

▸ Effective rate: 1–5%

▸ In some structures: ≈ 0%

- Loss of tax revenue

- Underfunded public services

- Lower productive investment

- Reduced innovation capacity

- Wage stagnation

- Youth emigration

Co-authorship: Augustus Veritas — Fragmentos do Caos News Team